franklin county ohio tax lien sales

How does a tax lien sale work. John Smith Street Address Ex.

Franklin County Treasurer Foreclosure

2021 TAX LIEN SALE.

. The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office. How does a tax lien sale work. 123 Main Parcel ID Ex.

Franklin County OH currently has 3664 tax liens available as of May 27. Buy Tax Delinquent Homes and Save Up to 50. If you are a property owner whose name is listed please click here for more information about your options.

After a lien is sold if all lien charges and interest are not fully paid after one year the tax lien. Tax lien purchasers and other interested parties with tax related issues. When a Franklin County OH tax lien is issued for.

First time applicants for a residential payment plan must make monthly payments. If you require further assistance please contact one of the following Franklin County government offices. As of October 17 Franklin County OH shows 34 tax liens.

Interested in a tax lien in Franklin County OH. Franklin County Clerk 2022 Tax Bill Sale Timeline for 2021 Delinquent Taxes April 18 2022. HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

These are liens for unpaid income payroll or business taxes. Ad Find Out the Market Value of Any Property and Past Sale Prices. Interested in a tax lien in Franklin County OH.

Ohio Tax Liens. Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. They can then fill out an application for re-sale of tax title property on particular parcel s - Land Sale Application for the commissioners to authorize the re-sale of the tax title property.

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. As of October 14 Franklin County OH shows 0 tax liens. Administering Tax Lien Sales.

The parcels listed in the link below were considered delinquent and included in the 2021 Tax Lien Sale. When a Franklin County OH tax lien is issued for. Search for Allen County Sheriffs real estate sales listings by address.

How does a tax lien sale work. Franklin County Auditor 373 S. Ohio would an excellent state for tax lien certificate sales except that the sales limited to institutional investors that can afford large.

Generally the minimum bid at an Franklin County Tax Deeds sale is the. Should you have questions please contact the Delinquent Tax Department at 614-525-3438. When a Franklin County OH tax lien is issued for.

If you havent received a notice of satisfaction from the party with the lien usually the Ohio Attorney Generals office then you should contact them first to get more information about. If your Ohio property taxes are overdue the county treasurer can start a foreclosure against you in court. See Prior Ownership History Sales Records Property Deed So Much More.

Sheriff turns UNPAID tax bills over to County Clerk at the close of business. High St 21st Floor Columbus OH 43215 6145254663. As of October 29 Franklin County OH shows 12 tax liens.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax-lien certificates in exchange for payment of the. Tax Lien Certificates - Ohio OH. 301 North Main St Suite 203 Lima OH 45801.

This guide addresses the problem of Ohio tax liens also called judgment liens. Franklin lot 73 010e049 08900 111 chicago av 010-005641-00 baer laurie. Register for 1 to See All Listings Online.

Interested in a tax lien in Franklin County OH. For tax lien certificates investors can get yields as high as 18 per annum with a one year right of redemption. On November 1 2021.

Search for a Property Search by. Franklin County Law Library. Net tax due fee due net lien value 010-000708-00 keens too llc 907 e fifth ave 864 e 4th ave bidleman lot 48.

The Delinquent Tax Division holds an annual tax lien sale to collect outstanding delinquent taxes. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Tax Deeds are sold to the bidder with the highest bid.

In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Franklin County Tax Deeds sale. Payment Credit Timeline. Call our office at 614 525-3438 to find out how much you owe and how you can make payments.

Franklin County Treasurer Delinquent Taxes

New Hampshire Foreclosures And Tax Lien Sales Search Directory

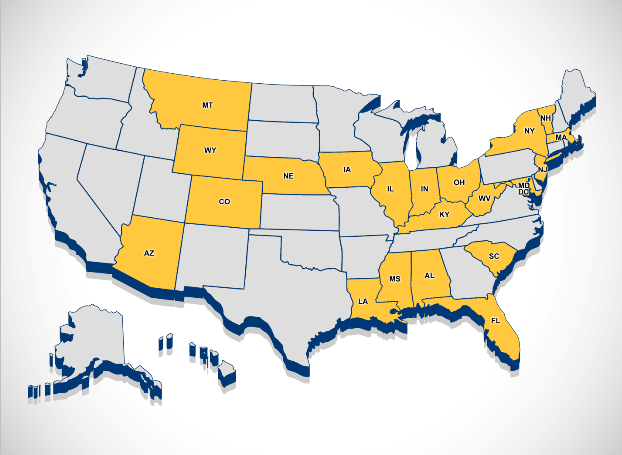

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Massachusetts Foreclosures And Tax Lien Sales Search Directory

Tennessee Foreclosures And Tax Lien Sales Search Directory

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

West Virginia Foreclosures And Tax Lien Sales Search Directory

Franklin County Treasurer Delinquent Taxes

Franklin County Treasurer Delinquent Taxes

Investing In Tax Liens In Ohio Joseph Joseph Hanna

Ohio Foreclosures And Tax Lien Sales Search Directory